The 2026 FIFA World Cup match schedule is finally here, and if you own a short-term rental in one of the host cities across the US, Canada, and Mexico, you’re sitting on a potential goldmine. But here’s the thing: most hosts will leave massive amounts of money on the table simply because they don’t know how to properly price an event of this magnitude.

In this guide, you’ll learn exactly which games will drive the highest demand, how to analyze your local market inventory, what booking patterns to expect, and most importantly, how to avoid the pricing mistakes that could cost you thousands of dollars in lost revenue.

Understanding the World Cup Format and Its Impact on Demand

Before we dive into specific pricing strategies, you need to understand how the World Cup works because it directly affects your revenue management approach.

The tournament begins with a group stage, with 48 teams divided into groups of four. Each team plays the other three teams in their group. After these matches, the top two teams from each group advance to the knockout stage, along with the highest-ranked third-place teams. This means only 16 teams get eliminated in the group stage.

Here’s why this matters for your pricing strategy: group-stage games will have varying levels of demand depending on which teams are playing. A match between England and Croatia will attract significantly more travelers than a game between Cape Verde and Ivory Coast. You can’t use a blanket pricing strategy across all game days.

City-by-City Game Analysis: Where the Money Really Is

Not all World Cup games are created equal. Let me break down which cities are hosting the biggest matches and what that means for your revenue potential.

Kansas City: The Hidden Revenue Champion

Kansas City might surprise you. It’s hosting some massive games, including Argentina versus Algeria, Tunisia versus the Netherlands, and Algeria versus Austria. But here’s the kicker: Kansas City is probably the smallest host city in terms of hotel inventory, with only about 10,000 to 15,000 hotel rooms.

Compare that to New York with 120,000 to 140,000 hotel rooms, and you start to see why Kansas City properties could see ADR increases of 500% to 1000% for the biggest games. The supply-demand equation is dramatically different in smaller markets.

Kansas City also has very strict short-term rental regulations, which means there is even less inventory competing for soccer fans desperate to find accommodation.

Dallas and Houston: Premium Match Destinations

Dallas secured some of the tournament’s marquee matchups. Netherlands versus Japan on the opening weekend will bring thousands of travelers from both countries. But the real money game is England versus Croatia on June 17th. England is one of the world’s biggest soccer nations with an incredibly passionate fanbase that travels in massive numbers.

Houston isn’t far behind with Germany versus Ivory Coast, Portugal matches, and the Netherlands playing there as well. These are all top-tier soccer countries where the sport is deeply embedded in the culture.

The Big City Paradox: New York, Los Angeles, and Miami

Here’s a counterintuitive insight: properties in the largest cities might not see the most dramatic price increases despite hosting major games. New York is getting Brazil versus Morocco and France versus Senegal, both huge matches. Miami has Scotland versus Brazil. Los Angeles has several US team games.

But these cities have so much hotel and short-term rental inventory that even 100,000 visitors won’t create the same supply crunch you’ll see in smaller markets. We manage properties in Atlanta and Miami, and during major NFL and college football games, we typically see only modest ADR increases because there’s just so much accommodation available.

This doesn’t mean you can’t raise prices significantly. It just means the ceiling is lower than in markets like Kansas City, Boston, or Philadelphia.

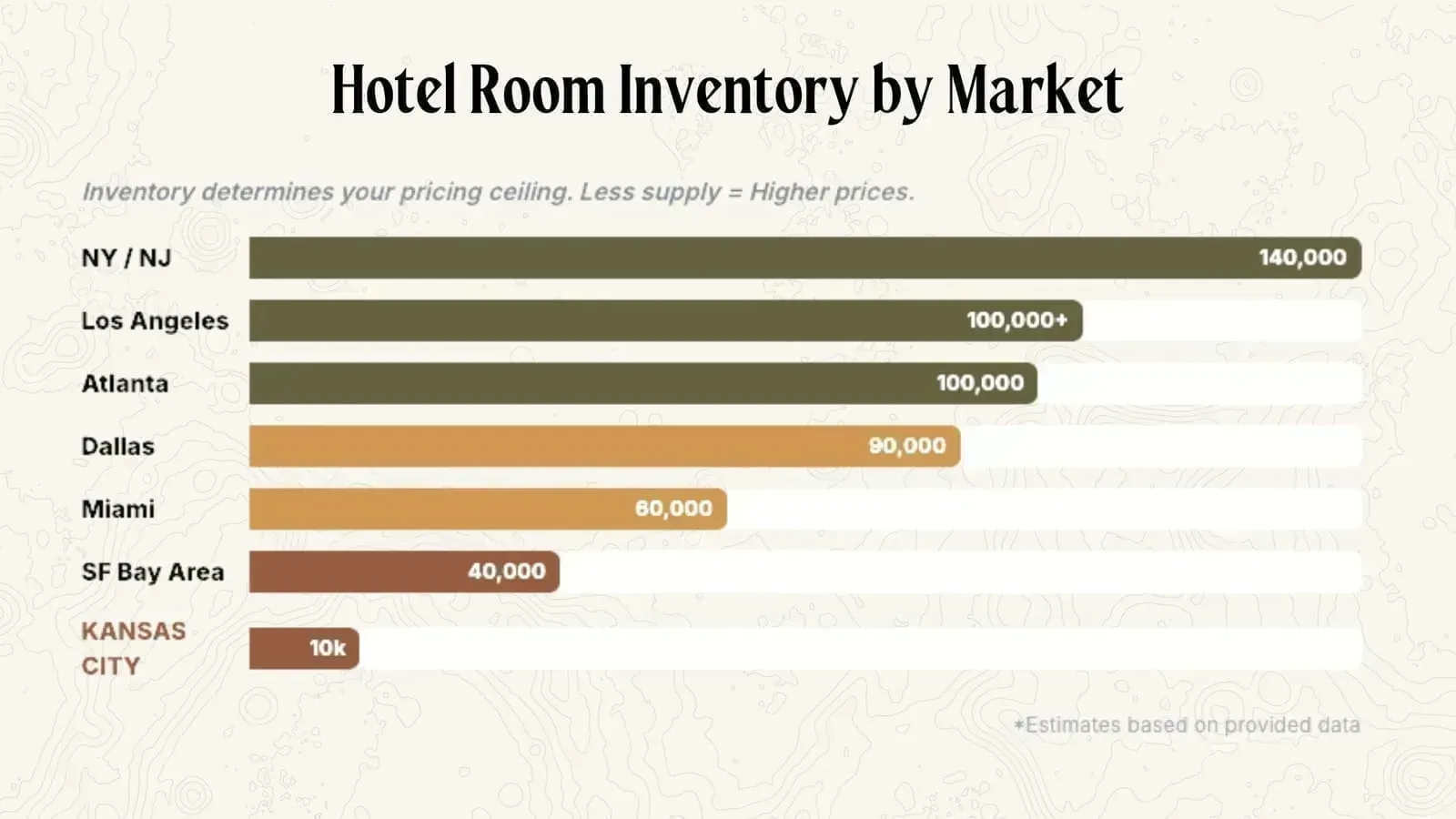

The Critical Factor Most Hosts Ignore: Hotel Room Inventory

The number one mistake hosts make when pricing for major events is failing to consider total market inventory. You need to understand exactly how many hotel rooms and short-term rentals exist in your market because this determines your pricing ceiling.

Here’s a breakdown of hotel room inventory in key markets:

- New York/New Jersey: 120,000 to 140,000 rooms

- Los Angeles: 100,000+ rooms

- Atlanta: 100,000 rooms

- Miami: 60,000 rooms

- Dallas: 80,000 to 90,000 rooms

- Houston: 75,000 to 90,000 rooms

- San Francisco Bay Area: 30,000 to 40,000 rooms

- Seattle: 30,000 rooms

- Boston: 20,000 to 30,000 rooms

- Philadelphia: 20,000 rooms

- Kansas City: 10,000 to 15,000 rooms

The smaller the inventory, the more dramatic your potential ADR increase. In Kansas City, with 10,000 hotel rooms, if 50,000 Argentina fans show up for a game, you’re looking at a massive shortage. In New York, with 140,000 rooms, that same 50,000 visitors barely make a dent.

Which Countries Send the Most Travelers?

Understanding which national teams have the most passionate traveling fanbases is crucial for predicting demand. Not all countries are equal when it comes to international soccer travel.

Tier One: The Revenue Drivers

England leads the pack. The English Premier League is the world’s most popular soccer competition, and England hasn’t won a World Cup since 1966. English fans travel in absolutely massive numbers, and they have the disposable income to pay premium prices for accommodation.

Germany is another heavyweight. Soccer is the national sport, it’s a wealthy country, and German fans are known for being extremely dedicated travelers. Any Germany match will drive significant demand.

Brazil and Argentina are the South American giants. These countries live and breathe soccer. Brazil has over 200 million people, and soccer isn’t just a sport there; it’s a cultural identity. Argentina, current World Cup champions, will bring passionate fans willing to pay top dollar.

The Netherlands shouldn’t be underestimated. It’s a smaller country population-wise, but the Dutch are fanatic about soccer and have high disposable income. They’re also visa-free for travel to the US, making it easy for them to book trips.

Tier Two: Solid Demand Generators

France, Spain, Portugal, and Belgium all have strong soccer cultures and wealthy populations. Colombia and Ecuador will bring significant South American contingents, especially since many people from these countries already live in the United States.

Japan and South Korea are interesting wildcards. Both are wealthy nations with growing soccer popularity. Japan, in particular, has been making deep runs in recent tournaments.

The Visa Factor You Can’t Ignore

Here’s something most hosts don’t consider: visa requirements dramatically affect booking timelines and volume. Travelers from countries requiring US visas typically wait to book until their visa is approved. They’re not going to risk paying for accommodation they might not be able to use.

European Union countries, Australia, New Zealand, Japan, South Korea, and most wealthy nations have visa-free or visa-waiver access to the United States. These countries will book earlier and in higher volumes because there’s no visa uncertainty.

Countries like Egypt, Algeria, Tunisia, and many African and Asian nations require visas. Expect later booking windows and potentially lower overall travel volumes from these markets.

Current Booking Patterns: What We’re Actually Seeing in the Market

As someone managing properties across multiple World Cup host cities, I can share real data on what’s happening right now in terms of bookings and pricing.

Since the match schedule was announced, we’ve seen booking activity pick up, but it’s not the tsunami many people expected. Occupancy for most games is sitting between 10% and 15% of available inventory. The main exception is the US, Canada, and Mexico home games, which have been bookable for months and show higher occupancy levels.

Here’s what’s interesting: larger properties with four, five, or six bedrooms are booking faster than one or two-bedroom units. This makes sense because group travelers often book earlier. Families and friend groups traveling together need to coordinate schedules and secure larger spaces, while individual travelers or couples can be more flexible.

ADR Benchmarks We’re Seeing Right Now

In Kansas City, properties are booking at 150% to 200% of last year’s rates for comparable dates. A property that rented for $100 per night last June is now booking at $200 to $300 for World Cup dates.

In larger markets like Dallas, Houston, and Boston, we’re seeing 50% to 100% increases compared to last year. Properties that normally rent for $200 are booking at $300 to $400.

But here’s my prediction: these numbers are going to go much higher. Many hosts haven’t yet properly adjusted their pricing. Some don’t realize the magnitude of this event. Others are waiting to see what happens. The properties booked now are often the ones that are underpriced relative to what the market will ultimately bear.

The Knockout Stage Changes Everything

While we’re focused on group stage games right now, don’t forget about the knockout rounds. The round of 32, round of 16, quarterfinals, semifinals, and the final are where things get really interesting.

These games will attract far more people than the stadiums can hold. We’re not just talking about ticket holders. For a semifinal or final, you could see 200,000 to 400,000 people descend on a city just to be part of the experience, even without tickets. They’ll watch in bars, fan zones, and public viewing areas. The atmosphere becomes the attraction.

The problem is that we don’t yet know which teams will make it to which knockout stages. Group stage results determine that. But you can make educated guesses based on FIFA rankings and group compositions.

Real-World Example: Learning from the Euro 2020 Finals

Let me share a relevant case study. When England reached the Euro 2020 finals at Wembley Stadium in London, the city was absolutely overwhelmed with fans. Ticket or no ticket, people just wanted to be there. Accommodation prices skyrocketed to levels five to ten times normal rates.

Some short-term rental hosts who properly anticipated this demand made more money during that one week than they typically made in an entire month. Others who didn’t adjust their pricing quickly enough left tens of thousands of dollars on the table.

The World Cup finals will be similar, just on a much larger scale, because it’s a more prestigious tournament with a much larger global audience.

Common Pricing Mistakes That Will Cost You Money

After managing properties through dozens of major sporting events, I’ve seen hosts repeatedly make the same mistakes. Here are the big ones to avoid:

Pricing too low, too early. Many hosts think they need to be one of the first properties booked to maximize occupancy. For the World Cup, this is backwards. The properties booking first are often just the ones priced lowest. With an event this massive, occupancy isn’t the issue. Nearly every property will book. The question is at what rate.

Using a blanket multiplier. Some hosts just say, “I’ll charge triple my normal rate for all World Cup dates.” This ignores the huge variance in demand between games. England versus Croatia deserves dramatically higher pricing than Cape Verde versus Ivory Coast.

Ignoring local competition. You need to actively monitor what comparable properties are pricing at and, more importantly, what they’re actually booking at. Create weekly ADR reports to track market movement.

Forgetting about minimum night requirements. For big games, implementing strategic minimum stays (such as a 3-night minimum around the match date) can dramatically increase your revenue. You don’t want someone booking just the game night if you could have rented those surrounding nights at elevated rates, too.

Your Action Plan for the Next 60 Days

Here’s exactly what you should do right now to maximize your World Cup revenue:

First, identify which games are happening in your city and categorize them by expected demand level. Use the analysis in this article as your guide. Mark the tier-one games (England, Germany, Brazil, Argentina) as your premium pricing opportunities.

Second, research your market’s total hotel and short-term rental inventory. This determines your pricing ceiling. Smaller markets can support much higher multipliers than large markets.

Third, set up weekly monitoring of your competitors’ pricing and booking patterns. Use tools like PriceLabs or AirDNA to track ADR trends. You want to see where the market is moving in real-time.

Fourth, resist the temptation to undercut the market. Remember, for an event like this, you want to be in the second or third wave of bookings, not the first. Let other hosts’ underpriced properties get scooped up first, and then your properly priced unit becomes the next available option.

Fifth, consider your cancellation policy carefully. World Cup travelers are booking months in advance with uncertainty about visa approvals, flight costs, and even which teams will advance to knockout rounds. A more flexible cancellation policy might allow you to command a small premium and attract bookings earlier.

Summary and Key Takeaways

The 2026 World Cup represents a once-in-a-generation revenue opportunity for short-term rental hosts in the right markets. But maximizing that opportunity requires a sophisticated, data-driven approach to pricing and revenue management.

Here are your main takeaways:

- Smaller host cities like Kansas City, Boston, and Philadelphia will likely see the most dramatic ADR increases (potentially 5x to 10x for major games) due to limited inventory

- Not all games are equal: England, Germany, Brazil, Argentina, and Netherlands matches will drive the highest demand and justify the most aggressive pricing

- Hotel room inventory in your market is a key factor in determining your pricing ceiling

- Current booking patterns show 10-15% occupancy for most games, with larger properties booking faster than smaller units

- Early ADR data shows 150-200% increases in small markets and 50-100% in larger markets, but these numbers will likely climb significantly higher

- Visa requirements affect booking timelines, with visa-free countries booking earlier and in higher volumes

- The knockout stages will bring exponentially more demand than group stage games

Next Steps: Take Action Now

Don’t wait until the last minute to optimize your World Cup pricing strategy. The hosts who start analyzing their markets now, monitoring competitor pricing, and implementing dynamic pricing strategies will maximize their revenue.

If you manage properties generating over $1 million in annual revenue and want professional revenue management specifically optimized for the World Cup, visit Freewyld Foundry to learn how we can help you capture every dollar of this opportunity.

What’s your biggest question about pricing for the World Cup? Which games are your city hosting, and how are you thinking about your pricing strategy? Drop a comment below and let’s discuss.