The Hidden Cost of “Good Enough” Revenue Management

You check your dashboard. Occupancy looks solid. Your revenue manager updates prices weekly. Compared to competitors, you’re holding your own. Everything seems fine.

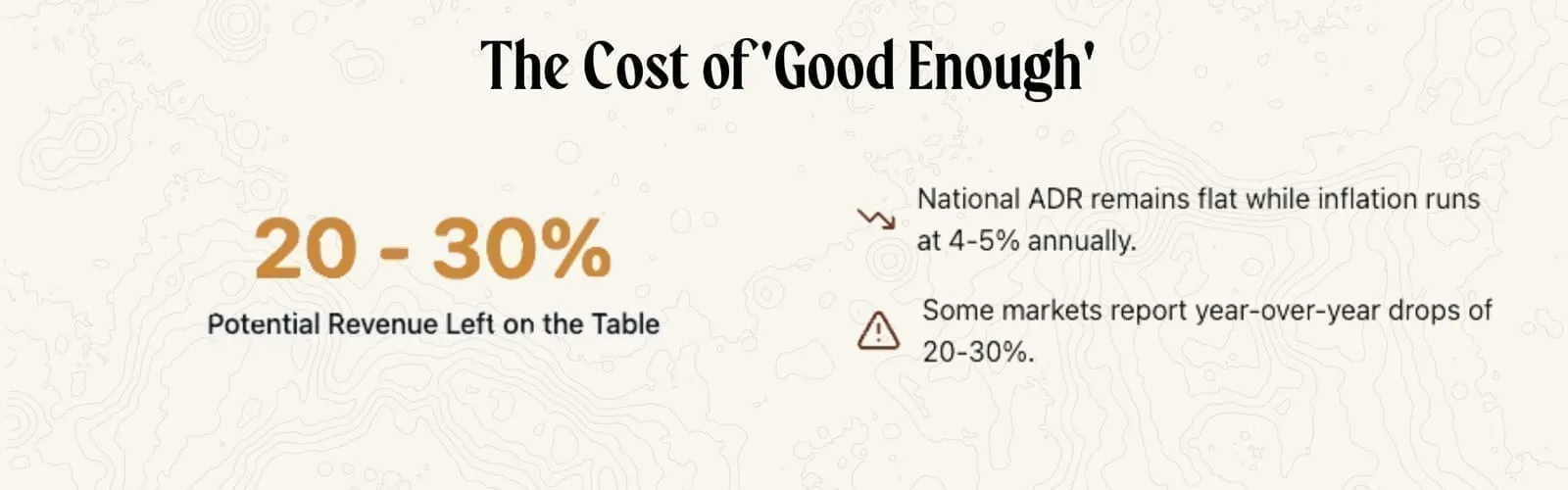

But here’s the uncomfortable truth: you might be leaving 20-30% of your potential revenue on the table without even knowing it.

According to KeyData’s newest trends report, most short-term rental operators say pricing is a top priority. Yet average daily rates remain basically flat while competition rises quickly. If everyone cares about pricing, why isn’t revenue moving?

The answer lies in the gap between doing something and doing something strategic. Many operators confuse activity with effectiveness. They’re in their pricing tools multiple times per week, making adjustments, reviewing graphs. But without a systematic approach, they’re essentially flying blind.

This article breaks down what the best operators do differently. You’ll learn the specific strategies mid-sized property management companies use to outperform their markets, why your current revenue manager might actually be costing you money, and the exact framework top performers follow to maximize revenue without adding operational costs.

What the Data Really Says About Pricing in 2026

KeyData surveyed approximately 240 operators across different sizes and markets about their priorities for 2026. Marketing and distribution topped the list, with pricing coming in second. Sound familiar? Pricing has held the number one or two spot for the last five years.

Yet operators rarely take meaningful action.

Why the disconnect? The short-term rental business demands constant reactive problem-solving. When a cleaner drops the ball two hours before check-in, you’re not thinking about pricing optimization. You’re thinking about getting that property guest-ready. Pricing gets pushed to tomorrow. But tomorrow brings new fires to fight.

The pattern repeats endlessly. Pricing never feels urgent enough to demand attention, even though it represents one of your biggest revenue opportunities.

Meanwhile, national ADR remains flat. Factor in inflation running at 4-5% annually, and your purchasing power actually declines year over year. In markets like San Antonio, some operators report revenue drops of 20-30% compared to last year.

The market isn’t getting easier. Competition increases. Guest expectations rise. Profit margins tighten. In this environment, revenue management becomes even more critical, not less.

The Mid-Sized Operator Advantage

KeyData’s report revealed something interesting about mid-sized companies. These operators, typically managing portfolios between 25 and a few hundred listings, show the most bullish outlook for 2026. They expect the biggest growth rates in the industry.

What makes them different?

First, they’re more tech-forward. Mid-sized operators adopt pricing tools and marketing systems at higher rates than smaller mom-and-pop operations. They update prices daily or multiple times per week instead of monthly or whenever they remember. They actively engage with their data rather than letting it collect digital dust.

Second, they operate in a sweet spot. They have enough scale to weather minor market fluctuations. A 10-15% demand shift or new regulation won’t sink the business. They have resources to adapt.

But they’re still nimble. Unlike massive management companies running thousands of units through layers of bureaucracy, mid-sized operators can implement changes quickly. New technology? They can test it this month. Strategy adjustment? No need to run it through an advisory board.

If you’re in this category and not leveraging your natural advantages, you’re basically volunteering to lose market share. The opportunity exists. The question is whether you’ll take it.

Why Most Revenue Managers Fail (Even the Dedicated Ones)

Here’s where things get uncomfortable. Having a revenue manager doesn’t guarantee good revenue management. In fact, a mediocre revenue manager might cost you more than having no revenue manager at all.

Consider this scenario. You hire an affordable revenue manager, maybe paying $1,200 monthly for someone managing 140 listings. Seems like a great deal. You’ve checked the box. Revenue management? Handled.

But if that person lacks the expertise to maximize your portfolio’s potential, you’re not saving money. You’re hemorrhaging it.

One operator in this exact situation switched to a more expensive revenue management service. Their monthly cost increased significantly. But their revenue jumped so much that the higher fee became essentially free. The additional revenue generated exceeded the cost difference. They were now paying less when accounting for the value delivered.

This illustrates a crucial principle: your revenue manager’s cost isn’t what you pay them. It’s their ability (or inability) to increase your revenue.

Think about it differently. That $1,200 monthly “bargain” might be costing you $10,000, $20,000, or $50,000 in missed revenue annually. The apparent savings becomes the most expensive choice you could make.

The challenge? You don’t know what you don’t know. Operators who think they’re already at the top of their market often discover 15-25% revenue increases are possible once they implement proper strategy. They were convinced no room for improvement existed. They were wrong.

What Strategic Revenue Management Actually Looks Like

Most operators spend time in their pricing tools without a real plan. They look at graphs. Check some bookings. Make random adjustments. Then they’re done until next time.

Strategic revenue management requires a systematic approach. Top performers follow daily, weekly, and monthly routines. They know exactly what data points to examine and how to make decisions based on those metrics.

Here’s what that looks like in practice:

Daily Process: Review pacing for listings in the booking window. Compare your pickup rate against targets. Adjust prices for underperforming dates. Monitor competitor positioning for high-value periods. Check for algorithmic visibility issues on your primary channels.

Weekly Process: Analyze booking patterns across your portfolio. Identify trends in guest behavior. Update seasonal adjustments based on market data. Review and refine length-of-stay discounts. Audit your pricing tool settings for optimization opportunities.

Monthly Process: Deep dive into channel performance. Evaluate your mix of OTA versus direct bookings. Review year-over-year comparisons for the upcoming months. Adjust long-term pricing strategies. Plan for upcoming events or seasonal shifts.

The difference between random activity and systematic strategy shows up in your bottom line. One operator might spend 30 minutes daily making changes that actually hurt revenue. Another spends the same time following a proven framework and generates thousands in additional monthly income.

The frustrating part? There’s limited education available. Hotel revenue management has university programs and professional certifications. Short-term rental revenue management? You’re mostly on your own, reinventing the wheel.

Controlling Pacing: The Most Important Concept You’re Probably Ignoring

Pacing control represents one of the most powerful revenue management concepts, yet only about one in 20 operators excel at it.

Pacing refers to how quickly your properties book relative to your goals. Are you filling up too fast (leaving money on the table) or too slow (risking empty nights)? The answer changes constantly based on how far out you’re looking.

For dates 90 days away, your goals differ completely from dates 30 days out. Three months from now, you might want 20% occupancy booked. Anything higher means you’re probably underpriced. One month out, you want 70-80% booked or you’re at risk.

Strategic revenue managers adjust pricing daily based on pacing. If a property books three months of weekends in one week, prices were too low. If nothing books for a month despite competitive pricing, something else is wrong (probably algorithmic visibility).

This requires constant attention. Not once a week. Not when you remember. Daily monitoring with a clear framework for decision-making.

The operators who master pacing optimization see dramatic results. Their properties stay competitively priced while capturing maximum revenue. They avoid the twin disasters of filling up too cheap or staying empty too long.

The OTA Dependency Problem (And Why It’s Getting Worse)

KeyData’s report showed direct bookings make up about 26% of average reservations but 38% of revenue. Higher rates, longer stays, longer booking windows. The math works in your favor.

Airbnb bookings? They average 45% of reservations but only 34% of revenue. Shorter stays, shorter booking windows, lower rates.

The shift toward diversification has accelerated recently thanks to Airbnb’s increasingly strict policies. A few less-than-five-star reviews can tank your search ranking. Listing suspensions are happening frequently for operators managing large portfolios. One bad day can wipe out a significant revenue stream.

Smart operators spread risk across multiple channels. They optimize for Booking.com’s Genius program. They invest in direct booking infrastructure. They test VRBO positioning. No single platform controls their fate.

But here’s the pricing complexity this creates: Perfect price parity across channels is basically impossible. Booking.com’s mobile discount stacks with Genius loyalty benefits. Airbnb offers new listing promotions. Your direct site has no commission markup.

Someone booking the same property on the same dates might see three different prices depending on their channel, loyalty status, and device. That’s not a problem to solve. It’s a reality to manage strategically.

Generally, direct bookings should offer the best rate. But exceptions exist. New listings need reviews, so you might price aggressively on one platform. High-value guests on certain channels justify channel-specific discounts.

The key is intentionality. Every pricing decision should serve a strategic goal, not just happen by default.

Real-World Example: From “Doing Fine” to Crushing It

One operator managed a 140-listing portfolio with an overseas revenue manager at a monthly cost of $1,200. Occupancy looked solid. Performance seemed competitive. They felt they were doing pretty well.

Then they switched to a strategic revenue management approach. The new service cost significantly more, which felt risky. But they trusted the process.

Within a year, their revenue increased so much that the higher monthly fee became essentially free when accounting for additional income generated. They were now paying less in real terms while receiving better service and taking the work off their plate.

How did this happen? The original revenue manager lacked a true strategy. They made changes reactively without clear frameworks. They missed opportunities in pacing control, channel optimization, and dynamic pricing adjustments.

The strategic approach implemented daily monitoring routines. Pacing got optimized continuously. Channel mix improved. Length-of-stay discounts got refined based on data. Small improvements compounded into major revenue gains.

This operator thought they were already maximizing their potential. They were leaving hundreds of thousands on the table without knowing it. The invisible cost of mediocre revenue management dwarfed the visible cost of the monthly fee.

Looking Ahead: The 2026 World Cup Opportunity

One major opportunity looms for 2026: the FIFA World Cup. This represents a potential revenue driver across the United States, especially in host cities.

The tournament brings international travelers who often extend their trips. Someone flying from New Zealand doesn’t just watch a game and leave. They explore the Grand Canyon, visit Yellowstone, and tour major cities. Short-term rental demand spikes in both host markets and surrounding regions.

The challenge is optimization. How many people will travel? How much can you charge? What’s your pricing strategy for different guest segments?

On December 5th, the tournament draw reveals which teams play in which cities. This matters enormously. Germany, Brazil, England, Argentina, Spain, and France – these soccer-passionate nations send massive numbers of fans. New Zealand or smaller qualifying countries? Far fewer.

Smart operators are preparing now. They’re getting their pricing strategies dialed in. They’re thinking about channel mix, length-of-stay requirements, and cancellation policies. The operators who treat this systematically will capture significantly more revenue than those who just hope for the best.

Summary & Key Takeaways

Strategic revenue management separates winning operators from the rest:

- Having a revenue manager doesn’t equal having good revenue management – expertise determines value, not just presence

- Mid-sized operators (25-200+ listings) are positioned perfectly to leverage technology and nimble decision-making for outsized growth

- Daily systematic processes beat random activity every time – know what to check and how to decide

- Pacing control represents the most underutilized revenue optimization technique available

- Channel diversification protects you from platform risk, while price consistency across channels is impossible (and that’s okay)

Next Steps: Take Action Now

Revenue management improvements flow straight to your bottom line without adding operational costs. Unlike marketing campaigns or amenity upgrades, better pricing doesn’t require capital investment.

The question isn’t whether you can afford to improve your revenue management. It’s whether you can afford not to.

If you’re managing over $1 million in annual bookings, we’ll analyze your current strategy and show you exactly where revenue opportunities exist in your portfolio.

Get your free revenue report at: freewyld foundry.com/report

What’s your biggest pricing challenge right now? Are you struggling with channel optimization, pacing control, or something else entirely? Drop a comment below and let’s discuss your specific situation.

Internal Links:

-

Ep675 – Airbnb’s New Cancellation Rules: What Every Host Needs to Know (October 2024 Update)

https://freewyldfoundry.com/ep675-airbnb-cancellation-policies/

-

Ep674 – Inside Freewyld: Building a Winning STR and Hospitality Culture

-

Ep667 – Airbnb 2026: How Pro Hosts Will Dominate the Game

External Links:

-

KeyData Vacation Rental Trends Report: https://www.keydatadashboard.com/blog/key-data-releases-2026-vacation-rental-industry-outlook-a-data-driven-look-at-the-year-ahead

-

Hostaway – “4 Revenue Management Best Practices for Short-Term Rentals”:

https://www.hostaway.com/blog/revenue-management-best-practices/ -

FIFA World Cup 2026 Official Schedule: https://www.fifa.com/en/tournaments/mens/worldcup/canadamexicousa2026