Why Your Revenue Manager Choice Could Make or Break Your Business

Running a profitable short-term rental business isn’t what it used to be. In today’s saturated market, the moment you choose a revenue manager becomes a turning point that determines whether you simply break even or build real wealth.

Back in 2012, when platforms like Airbnb were just gaining traction, money was practically lying on the table. You could list a few properties, do basic pricing, and watch the profits roll in.

Today’s market is completely different. Expenses are climbing. Competition is fierce. And margins are getting squeezed from every direction.

Here’s what most operators miss: revenue management isn’t just another task on your to-do list. It’s the difference between breaking even and building real wealth.

In this guide, you’ll learn exactly how to evaluate your three main options for revenue management, what each choice actually costs you (including hidden expenses), and how to spot red flags when hiring. Whether you manage 5 properties or 50, this decision will directly impact your bottom line.

The Real Cost of Getting Revenue Management Wrong

Before we dive into your options, you need to understand what’s actually at stake here.

Let’s run through a real scenario. Say your portfolio generates $1 million in annual revenue across 20 listings. If you’re managing properties for others at a 25% management fee, that’s $250,000 in revenue for your company.

Now imagine you hire a revenue manager who doesn’t really know what they’re doing. Performance drops just 10%. Your gross revenue falls to $900,000, which means you’re losing $25,000 in management fees.

But wait. You’re paying that revenue manager $50,000 per year. So the real cost? You’re down $75,000 total.

Here’s where it gets painful. A skilled revenue manager could have increased your revenue by 20% instead. That would put your gross at $1.2 million, adding $50,000 to your bottom line. Compare that $50,000 gain to your $25,000 loss, and you’re looking at a $75,000 swing.

For owner-operators or master lease holders, these numbers get even more dramatic because every additional dollar goes straight to your pocket. A 20% increase on $1 million means $200,000 more revenue with minimal additional expenses beyond the revenue manager’s compensation.

This isn’t theory. These are the actual results operators see when they finally get revenue management right.

Option 1: Managing Revenue Yourself (When It Works and When It Doesn’t)

Doing your own revenue management seems like the obvious choice when you’re starting out. You’re motivated, you know your properties intimately, and you don’t have to pay anyone else.

The upside is clear: Full control. No salary expenses. Direct connection to your business performance.

But here’s what nobody tells you about the DIY route.

Revenue management requires serious analytical skills. You need to understand market dynamics, competitive positioning, booking windows, and seasonal patterns. You need to know when to hold firm on pricing and when to drop rates to capture demand.

Most importantly, you need education. And that’s where most operators struggle.

When Freewyld Foundry started focusing exclusively on revenue management, the founders searched everywhere for quality training. Conferences, online resources, expert consultations. The conclusion? **There’s shockingly little solid education available in the short-term rental space.

**

“False Gurus”

YouTube and Instagram are flooded with “revenue management experts” giving conflicting advice. Some of it’s valuable. Much of it will actively hurt your business. And when you’re learning, you can’t always tell the difference.

If you’re going to own revenue management yourself, invest in legitimate training. Take courses from pricing tool providers. Join mastermind groups with experienced operators. Learn from people who actually manage portfolios, not just people who talk about managing portfolios.

The DIY approach works best when you genuinely enjoy working with numbers, you have time to dedicate to ongoing education, and your portfolio is small enough that you can give each listing proper attention.

To bridge the gap between amateur guesswork and professional execution, we created Cashflow Mastery. This 12-week comprehensive program is the “missing link” in STR education, designed to turn you into a revenue management expert using the exact systems we use to manage millions in bookings.

Whether you are launching your first property or scaling a multi-unit empire, Cashflow Mastery provides the tools, rhythms, and advanced tactics needed to outperform your market and increase your revenue by at least $20,000 in the next 12 months, guaranteed.

Master your revenue and join Cashflow Mastery here.

Option 2: Hiring an In-House Revenue Manager (The Hidden Challenges)

This is the question that comes up constantly: “Why wouldn’t I just hire someone in-house?”

It’s a fair question. Having a dedicated team member seems ideal. They’re fully integrated into your culture, communication is seamless, and they’re focused entirely on your portfolio.

But here’s the reality that most operators don’t expect.

Finding a truly skilled revenue manager who understands short-term rentals is incredibly difficult. Freewyld Foundry has hired five revenue managers over two years. We’ve worked with specialized recruiting firms. We’ve paid significant headhunting fees. And we’ll tell you straight up: it’s not easy.

Here’s why. The best revenue managers already have jobs. They’re not browsing job boards. You have to convince them to leave their current position, which means competing on salary, benefits, and opportunity.

Then there’s the short-term rental knowledge gap. Plenty of people have strong analytical skills. But understanding how Airbnb’s algorithm works, how guests choose properties, how distribution channels interact? That requires specific industry experience.

Some companies try hiring from the hotel industry. These candidates bring revenue management expertise, but they need extensive training on short-term rental operations. Unless you already have comprehensive training materials, that education process becomes your responsibility.

The bigger question: How do you know if you’ve hired someone good?

If you don’t understand revenue management yourself, evaluating a candidate becomes nearly impossible. And even after hiring, how do you hold them accountable? Results seem straightforward, but they’re actually complex to interpret.

Revenue performance gets affected by new listings, owner blocks, market conditions, seasonal patterns, and a dozen other variables. If your portfolio is down 10% year-over-year, is that bad performance? Not if the market is down 20%.

This creates a catch-22. To hire a great revenue manager, you need to understand revenue management. But if you understand it that well, you might not need to hire someone.

The in-house route works best when you have the resources to conduct a thorough hiring process, you can provide or pay for comprehensive training, and you understand the discipline well enough to evaluate performance accurately.

Option 3: Working with a Revenue Management Service Provider

Service providers offer a different model entirely. Instead of hiring one person, you’re partnering with an entire team.

The immediate advantage? No key person risk. If someone on their team gets sick or leaves, your revenue management doesn’t stop. They have backup systems and multiple team members who can step in.

You’re also buying expertise. Established service providers work with hundreds or thousands of properties. They see patterns across markets. They know what works and what doesn’t because they’re testing strategies constantly across a large portfolio.

But you’re not getting a full-time employee. You’re getting shared attention across their client base.

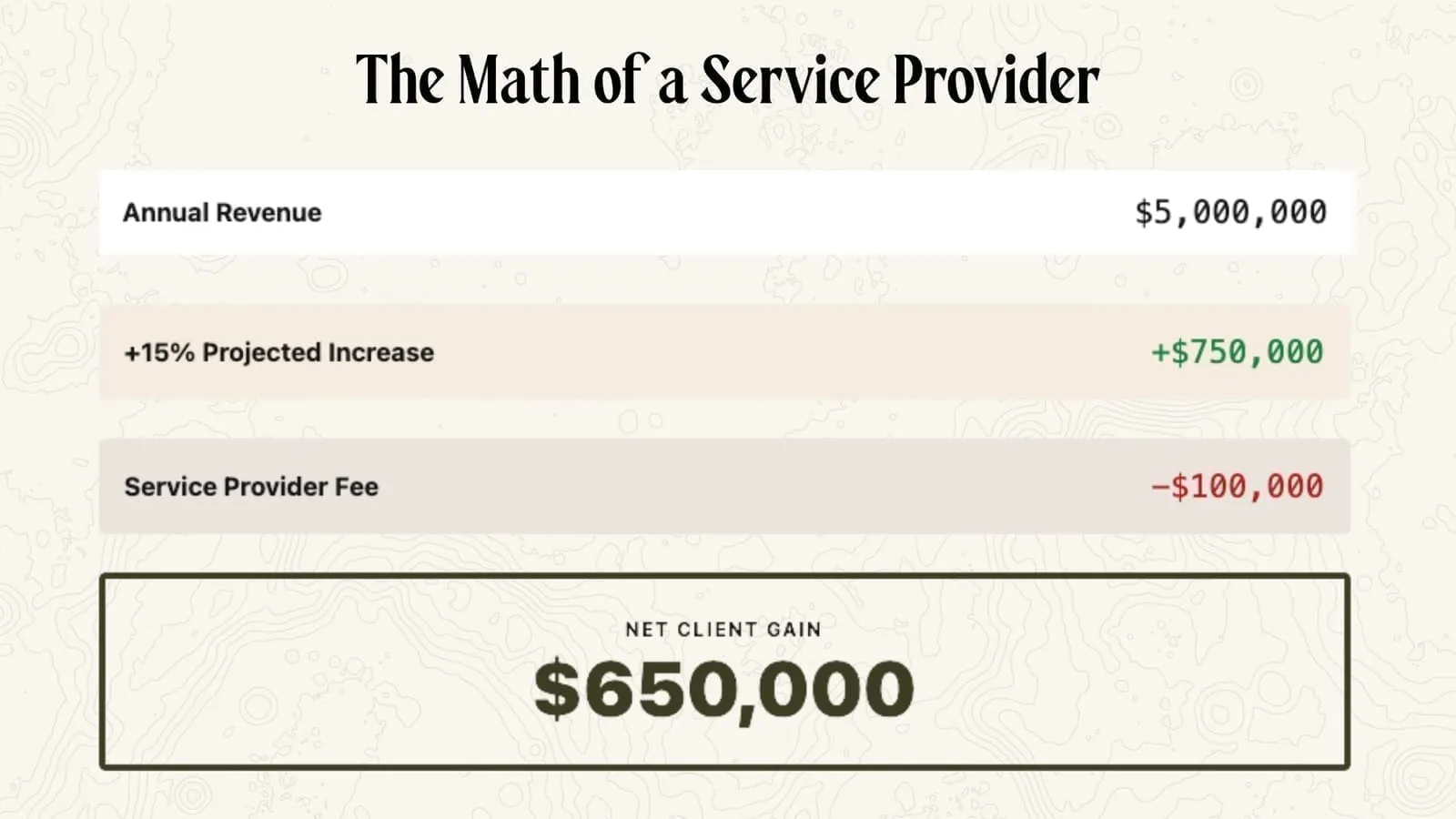

Here’s what actually matters though: results. Can they increase your revenue enough to justify their fees?

Consider this example. Freewyld Foundry recently onboarded a client doing $5 million in annual revenue. They’re projecting a 15% increase. That’s $750,000 in additional revenue. Even if the service fee is $100,000, the client nets an extra $650,000.

That’s the math that matters when evaluating service providers.

Good revenue management companies also bring broader business expertise. At Freewyld Foundry, the team has 25-30 years of combined experience running short-term rental businesses. They’ve worked with over 1,000 students. So when clients have questions about operations, marketing, or distribution, they get guidance beyond just pricing strategy.

What to Look for When Hiring a Revenue Management Company

Not all service providers are created equal. Some will genuinely transform your business. Others will drain cash while delivering mediocre results.

Here are the non-negotiables:

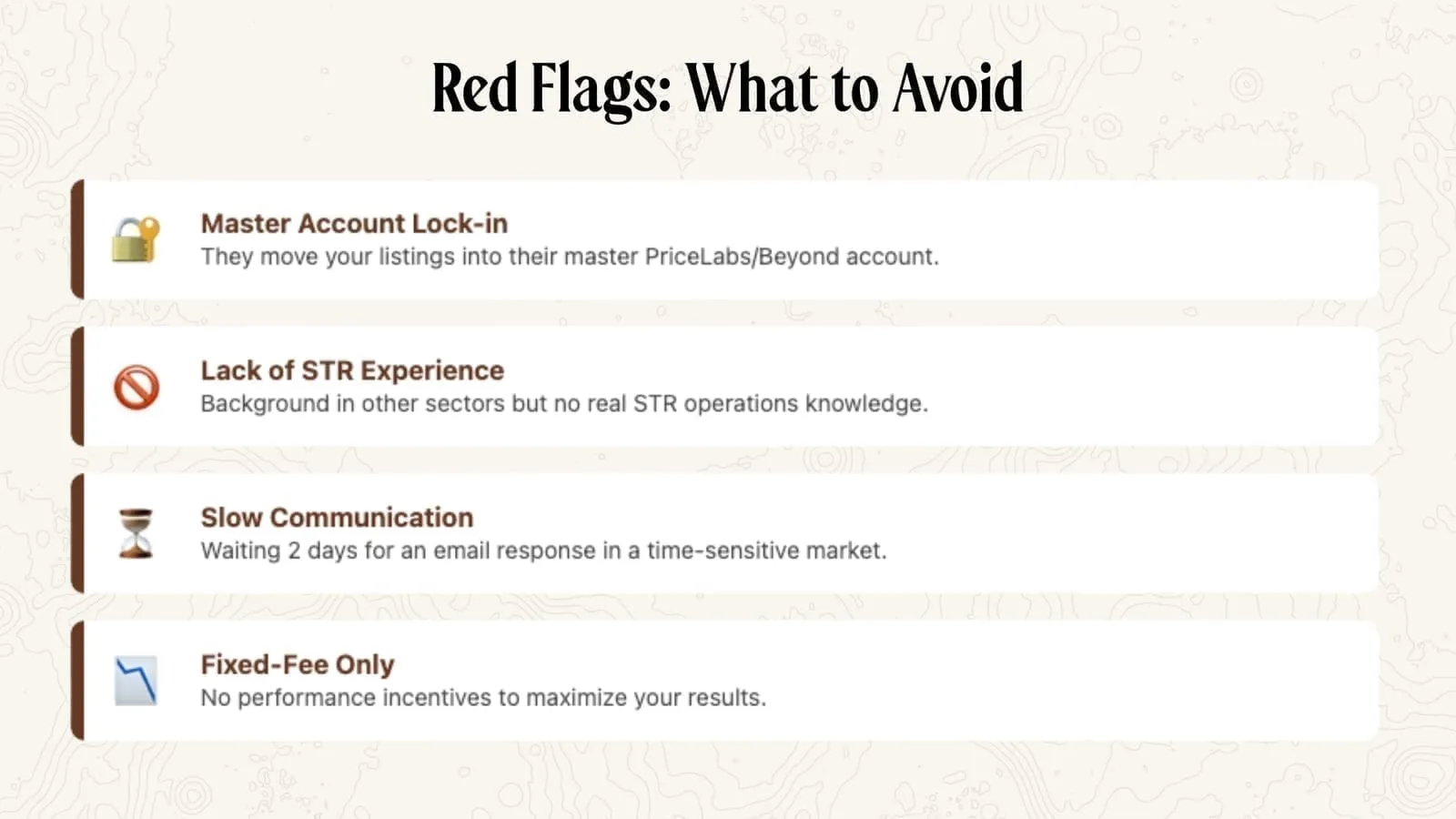

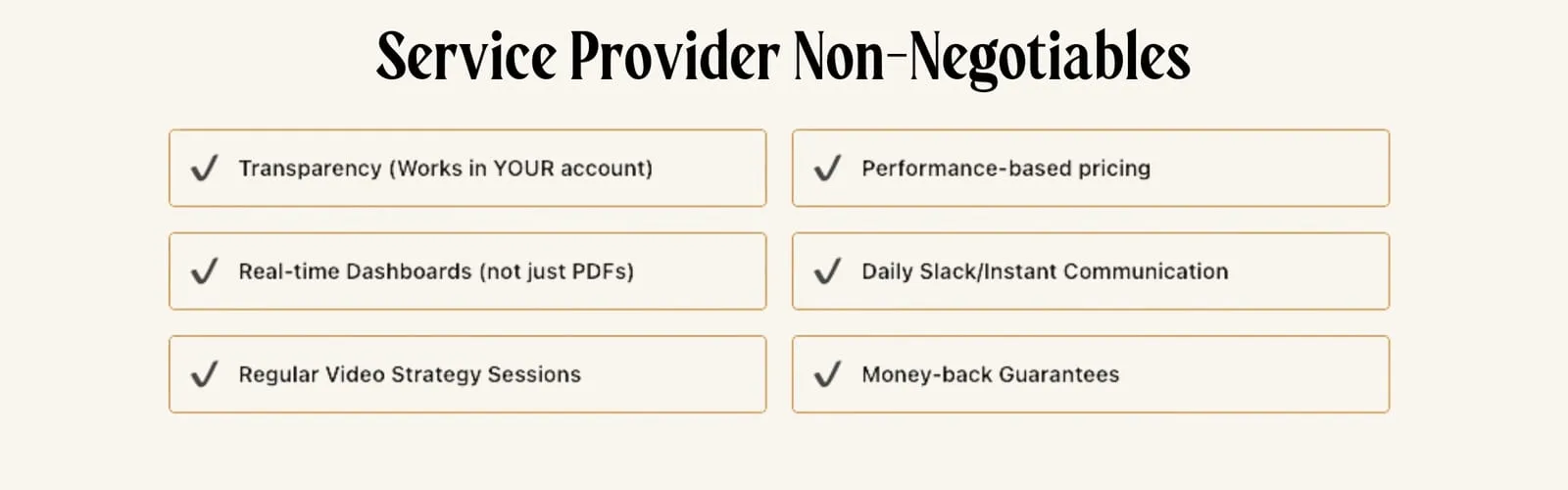

Access to your pricing tool. This is crucial. Some companies move your listings into their master PriceLabs or Beyond Pricing account. That locks you in. You can’t see their strategy. You can’t provide feedback. And if you want to leave, transition becomes a nightmare.

Work with companies that operate in your account. This gives you full transparency. You can log in anytime and see exactly what they’re doing. You can offer feedback based on local knowledge. And if the relationship doesn’t work out, you keep the strategy they’ve built.

Team transparency. Visit their website. Who actually works there? How long have they been in business? Do the founders operate their own portfolios? If you can’t find this information easily, that’s a red flag.

Some companies appear to be opportunistic plays by people who saw a growing industry. They might have revenue management experience from other sectors, but no real short-term rental operations background. That gap matters.

Performance-based pricing. This is where incentives align. Companies charging a percentage of revenue make more money when you make more money. Fixed-fee structures have no incentive to maximize your results beyond keeping you as a client.

At Freewyld Foundry, team members earn more when client portfolios perform better. Everyone’s motivated to drive results, not just maintain the status quo.

Guarantees. What happens if they don’t deliver? Reputable companies put their money where their mouth is. Freewyld offers a guarantee: if they don’t increase your revenue year-over-year (with reasonable exceptions for market conditions and the initial stabilization period), you don’t pay the service fee that month.

They’ll also be honest during the sales process. If your revenue management is already solid and they estimate less than 10% improvement potential, they’ll tell you. They might still work with you, but they’re transparent about expected results.

Real-time reporting. Monthly PDF reports aren’t enough. You need dashboard access where you can check performance anytime. Good dashboards break down performance by listing, distinguish between new and established properties, account for owner blocks, and show market comparisons.

Daily communication. Revenue management is time-sensitive. Waiting two days for an email response is unacceptable. Look for companies offering Slack channels or similar real-time communication. At Freewyld, clients can reach their revenue manager, client success team, and founders directly during business hours, usually getting responses within minutes.

Regular check-ins. You should have video calls with your revenue management team at least twice monthly. These aren’t just status updates. They’re strategy sessions where you share local knowledge, ask questions, and collaborate on optimization.

Your market expertise is valuable. You know about upcoming events, development projects, and local dynamics that affect demand. Revenue managers need that information to make smart decisions.

Real-World Example: The Cost of Choosing Wrong

One Freewyld Foundry client came to them after a frustrating experience with another provider.

She’d been managing revenue herself successfully. But as the portfolio grew, she needed help. She hired a company that seemed legitimate. They moved all her listings into their master pricing account.

Performance started declining. She couldn’t see what they were doing. When she asked questions, responses were slow. After several months of watching revenue drop 5-10%, she decided to make a change.

The transition was painful. The previous company wouldn’t give her access to their pricing tool. So in one day, all her listings transferred from their account to Freewyld’s. The new team had to immediately set up pricing from scratch across the entire portfolio.

During this process, she lost revenue. Had she worked with a company operating in her own pricing tool, the transition would have been seamless.

The lesson? Choosing the wrong partner costs you twice. First in lost revenue during the relationship. Then again in the difficult transition away from them.

Making Your Decision: Which Option Fits Your Situation?

Each approach works in the right circumstances. Here’s how to think through your specific situation.

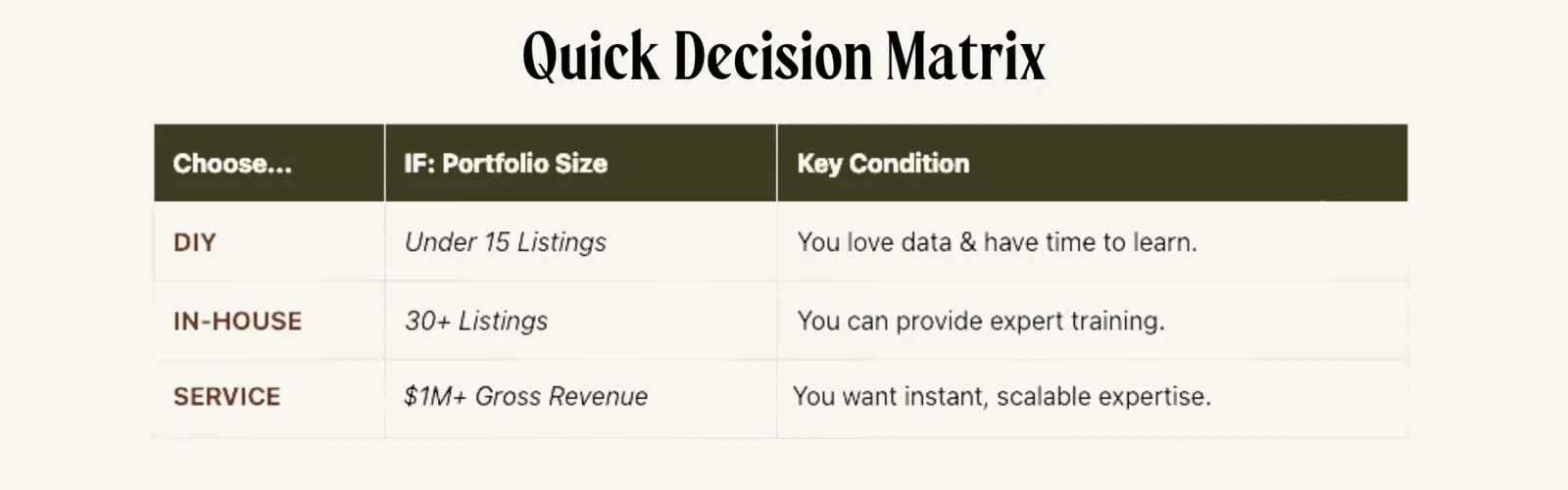

Choose DIY if: Your portfolio is under 10-15 listings, you enjoy working with data and numbers, you have time to dedicate to ongoing education, and you’re willing to invest in quality training programs.

Go for in-house if: You’re ready to invest significant time in finding the right person, you can provide or pay for comprehensive training, your portfolio is large enough to justify a full-time salary (probably 30+ listings), and you understand revenue management well enough to evaluate candidates and hold them accountable.

Choose a service provider if: You want immediate access to expertise without the hiring process, you need consistency that doesn’t depend on one person, you lack time or interest in managing this yourself, and your portfolio generates enough revenue that a percentage-based fee makes sense (typically $1 million+ in gross revenue).

There’s no universal right answer. But there is a right answer for your specific situation, goals, and resources.

Summary: Key Takeaways for Selecting Your Revenue Manager

Here’s what matters most when making this decision:

- Revenue management expertise directly impacts your bottom line. The difference between mediocre and excellent can easily be 15-20% of your gross revenue.

- DIY requires serious education. Don’t rely on random YouTube videos. Invest in legitimate training from people who actually operate portfolios.

- Hiring in-house is harder than you think. Great revenue managers with short-term rental experience are rare. Be prepared for a lengthy search and significant training investment.

- Service providers eliminate key person risk. You’re working with a team, not depending on one individual’s availability and expertise.

- Transparency matters more than anything. Whether you hire in-house or work with a provider, you need full visibility into strategy and performance.

- Align incentives properly. Percentage-based compensation ensures everyone benefits from better results.

Next Steps: Take Action on Your Revenue Management Strategy

The worst choice you can make is no choice at all. Letting revenue management drift without clear ownership costs you money every single day.

Start by honestly assessing your current situation. Are you maximizing revenue right now? How do you know? What would a 15% increase mean for your business?

If you’re doing over $1 million in net rental revenue and want a professional analysis of your revenue potential, Freewyld Foundry offers a free revenue report. They’ll analyze your portfolio, show you where improvement opportunities exist, and give you honest advice about whether you should work with them, hire in-house, or continue managing it yourself.

You can request that analysis at freewyldfoundry.com/report.

Two questions to consider: What’s the biggest challenge you’re facing with revenue management right now? And if you could increase your revenue by 20% this year, what would that change for your business?

Internal Links:

-

Ep679 – 2026 Pricing Strategies Every Short-Term Rental Operator Must Use

https://freewyldfoundry.com/ep679-str-pricing-strategies-2026/

-

Ep674 – Inside Freewyld: Building a Winning STR and Hospitality Culture

External Links:

- PriceLabs Revenue Management Strategies: https://hello.pricelabs.co/blog/revenue-management-strategies/

- Airbnb Hosting 101: A Beginner’s Guide: https://www.airdna.co/guides/beginners-guide-to-airbnb-hosting